Individual Disability Insurance May Not Be Enough

Individual Disability Insurance May Not Be Enough

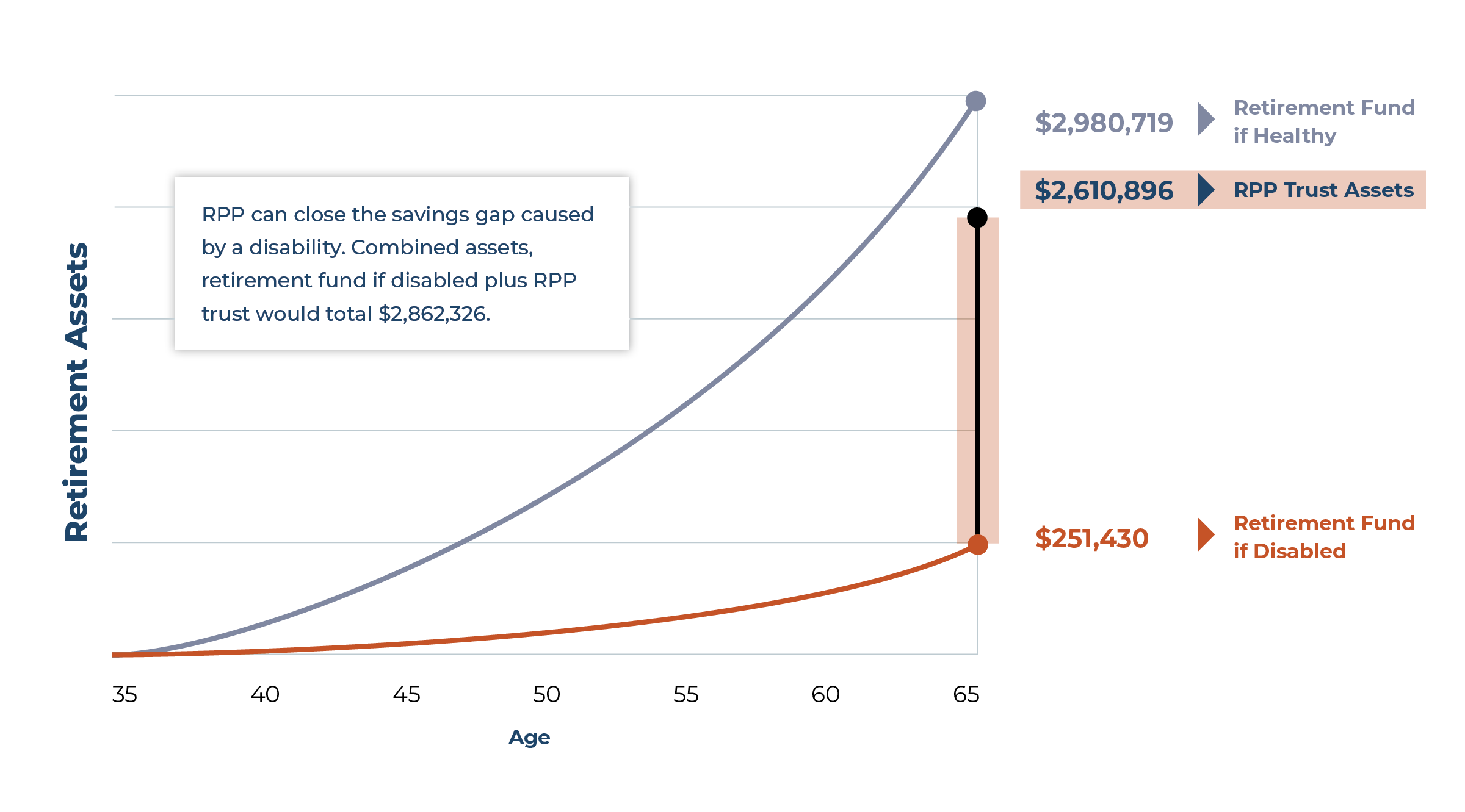

Hopefully, you already protect your ability to earn an income with an individual disability insurance policy. That is designed to maintain your current standard of living should you suffer an illness or accident and pay benefits normally until retirement age. But what if you have a very long-term claim or become permanently disabled? Your individual policy is probably not going to be enough to also properly fund your retirement account while on a claim, you are going to need something else for that!

When Your Income Suddenly Stops

What would happen to your retirement funding if you were to become disabled around age 35 and your income suddenly stopped? How would you continue to fund your retirement account? Chances are you will not have saved enough to retire at that age (you may become disabled at age 35 or 47-- who knows?), but most everyone will not have saved enough to retire at that young age.

What are the Odds it Will Happen to Me?

You may think that you will never become disabled, but those under age 35 have a 33.3% chance of becoming disabled for at least six months during their working careers. Men have a 43% chance of becoming disabled during their working years and women have a 54% chance! You may want to look into a special disability insurance program that replaces your retirement savings in the event of sickness or injury that prevents you from working. This Retirement Protection Plus (RPP) disability policy is available to you and can be purchased regardless of how much other disability insurance coverage you may have already.